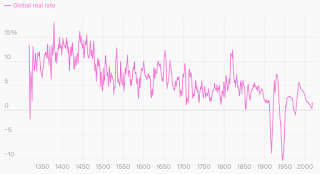

Lion brains have been baffled by why real returns were so high in the 1350's & declined so consistently throughout the renaissance, the industrial revolution, & today. The school answer is if technology advances, the chance of a speculative asset paying more than a bond increases, but surely bondholders would figure this out & demand interest comparable to speculative assets.

Lately started the Dorsey Armstrong lecture series on black death. The graph of real returns started during the time of the black death. The graph shows a brief but sharp downward spike before the black death, followed by the highest returns ever recorded in history after the black death.

The black death is known to have dramatically increased the leverage of peasant workers by decreasing their numbers. Who buys most of the bonds in today's world because they can't afford to lose on speculative assets? The peasant workers. Making money inspeculative assets tends to require large amounts of wealth to buffer losses & also having the connections & influence required to access inside trading information, which tends to favor members of the top 1%.

There's a good case for real returns over the last 800 years reflecting the leverage of the bottom 99% on the top 1%, starting with the black plague dramatically increasing said leverage, because they're the ones who owned most of the bonds. The less leverage the workers had, the less the top 1% had to pay them for loans. Right before the black plague, workers were famously in surplus numbers & they were accepting negative rates just like today.

It definitely agrees with the marxist theory, but central planning hasn't worked out for the bottom 99% either. The government has merely become a reflection of the laws of nature, issuing devalued currency in exponential amounts because the bottom 99% has no leverage to demand higher interest rates.

Much like before the black plague, the bottom 99% either has to shrink or find more land, like interplanetary land.

Comments

Post a Comment