What lions think is happening is index funds are earning interest on large treasury positions. They're putting the interest into stonks to manetain a constant allocation. It's not millennials pouring money in the stonk market expecting lower interest rates. High interest rates are pushing up stonks like the 90's.

Millennials are taking money out of the stonk market to buy houses & pay their mortgages.

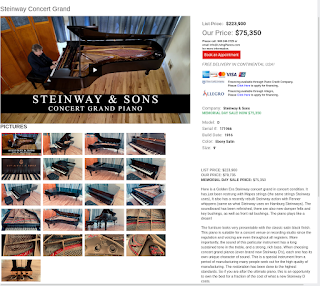

Important reminder that lions would only barely get by & be fairly unhappy if they retired now, drained their savings to buy a house, & couldn't afford a lot of things they hoped to have. Lions don't expect to have the coordination required to play it, when the time comes. Maybe they could just play chords. Would definitely have to learn how to tune it & regulate it.

If lions didn't have to buy a house, things would be better.

40 years ago, bonds were called fixed income because the standard method was to use interest as a source of income in retirement. Today, no-one expects interest to stay positive for long so that term has been replaced by calling 100% index funds a lazy retirement portfolio.

Lions are sitting on the fence, but as stonks lift off, it might be time to abandon 60/40, 50/50 & shoot for enough cash to retire if stonks lost all their value with the rest in stonk, just in case the fed takes the L train.

Comments

Post a Comment