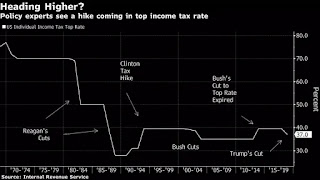

Rarely seen view of the top income tax rate over the last 50 years. Obviously, no-one will ever publish the tax rate over the last 100 years because then it would go back to 0.

While it's going back up, no-one is going to pay it. They'll just take more compensation as stock or stop working completely. The top earners don't get paid on a payroll like the rest of us. The only ones who will pay the new tax are going to be working class in Calif*.

It's long been accepted that the 80% bracket caused wealth inequality to be lower in the past, but why didn't all the after tax fortunes that were made before the 80% bracket persist after the creation of the higher tax bracket? Another theory is the crash of 1929 caused everyone to become equally poor & it just took 40 years for the power curve to redevelop on its own.

Comments

Post a Comment